Noventiq’s Big Data solution helps MyMoneyMantra leverage data for improving conversion and Marketing ROI

MoneyMantra (MMM) is a well‐known and first of its kind online marketplace in India that provides services related to fast loans, credits and insurance. They sought Big Data solutions as they were finding it difficult to integrate the data from various sources and leverage it efficiently for improving employee productivity and marketing revenue. Our approach enabled MMM to integrate and de‐duplicate data with a well‐designed data lake. They were also able to optimise data to channel marketing campaigns through visualization, reduce time to market and enhance employee productivity.

01. About

MyMoneyMantra (MMM) acts as an online marketplace that makes it easier for consumers to get affordable loans, credit cards and insurance covers. MMM is a well‐established organisation that extends services across 500 cities and partners with more than 100 reputed financial institutions. The pioneering financial company has done more than 45,000 crores of business in Indian rupees.

MMM helps users choose a loan by giving them information to compare and select products and process their documents to facilitate approval and disbursement. These processes involve collecting and using a lot of data for key functionalities:

- Multiple teams extract data from various sources such as users, lenders, borrowers, third parties and local sources in different formats

- With the information, different teams reach out to prospects through calls and marketing campaigns that involve social media or other channels

02. Business Challenge

03. Technical Challenge

The main challenge was that they did not have an effective system to integrate, de‐duplicate and structure the data and appropriate it to different applications for optimal productivity and revenue acceleration. Data visualisation for various purposes was missing leading to delay in analytics and insights for making business decisions.

Other hurdles that MMM had with the existing data setup:

- Difficulty with identifying the exact number of target prospects for each campaign

- Data retrieval was complex and time consuming

- No single source of truth

Such complexity was dragging down operations across the organization and slowing down all data users, business users, developers and data scientists

04. Proposed Solution

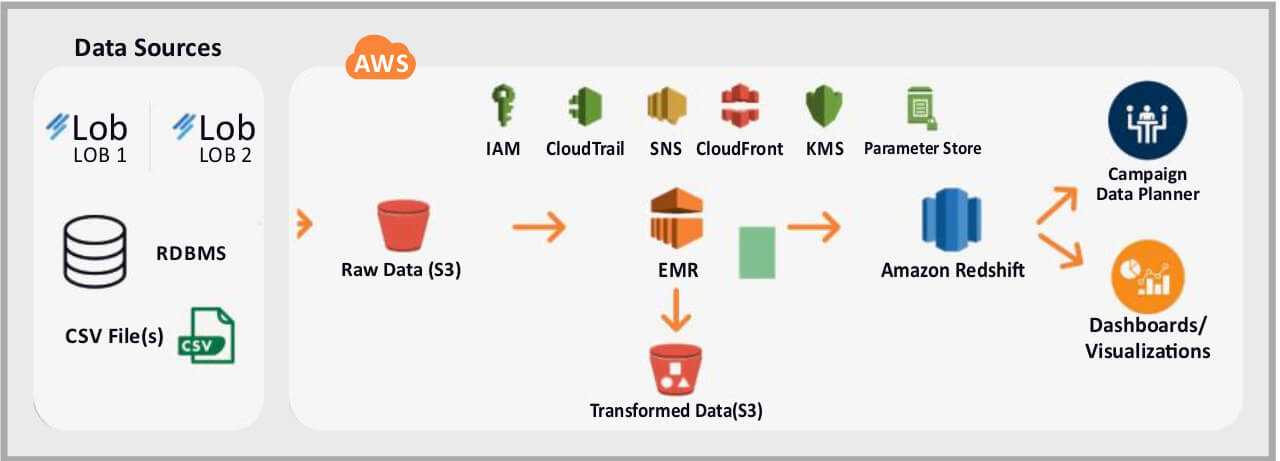

We approached the problem with a three‐pronged strategy. This involved creating a data lake to easily integrate data from various sources; de‐duping the data and interlinking the data with various applications; and ingesting the data into the Datawarehouse (Customer Management System) to manage customer records. A dynamic web‐based campaign data planner application enables business users to develop marketing campaigns from the aggregated data. The MMM team is able to run the campaigns productively and capture performance data to gain insights for better planning.

Data Lake

Data redundancy was the primary issue that was affecting efficiency, quality and customer experience. To first solve this hurdle, we began by creating a data lake, accumulating data from five major sources:

- MMM's lead management system

- Various campaign service providers with campaign performance reports

- Offline and online data from Credit Information Bureau (India) Limited (CIBIL)

- Banks and financial institutes that provide information through reverse Management Information System (MIS)

- Raw files that come from multiple sources

Transformation and Datawarehouse

The data from the lake was de‐duped and interlinked through the AWS ETL layer. The ETL layer helped load the raw data and other data points to other applications like the lead management system and the marketing campaign management systems.

Using the ETL layer, the data was then ingested into the customer management system or data mart to manage unique customer records.

Campaign Data Planner

05. Business Benefits

- Return on investment on the marketing campaigns has greatly improved

- Are able to propose the right loan products based on the loaning history and credit score

- Have reduced time to market for new products and services

- Can interpret complicated data, capture trends and identify customer patterns and decrease analytical build times by more than 30%

- Have increased upsell, cross sell opportunities for the sales team due to data accuracy

Related Success Stories

Healthcare

Big Data and Analytics

Digital Entertainment

Big Data and Analytics

MyTeam11

Big Data and Analytics